The future of client money management

An exclusive white paper on SRA alignment, real world adoption of TPMAs and practical steps firms can take now.

![]() Regulatory insight with clear SRA context

Regulatory insight with clear SRA context

![]() Proprietary sector research and attitudes to client money

Proprietary sector research and attitudes to client money

![]() Jargon free guides to TPMA and hybrid models

Jargon free guides to TPMA and hybrid models

FCA regulated ![]() £8bn+ securely processed

£8bn+ securely processed ![]() Trusted by the UK's top 100 law firms

Trusted by the UK's top 100 law firms

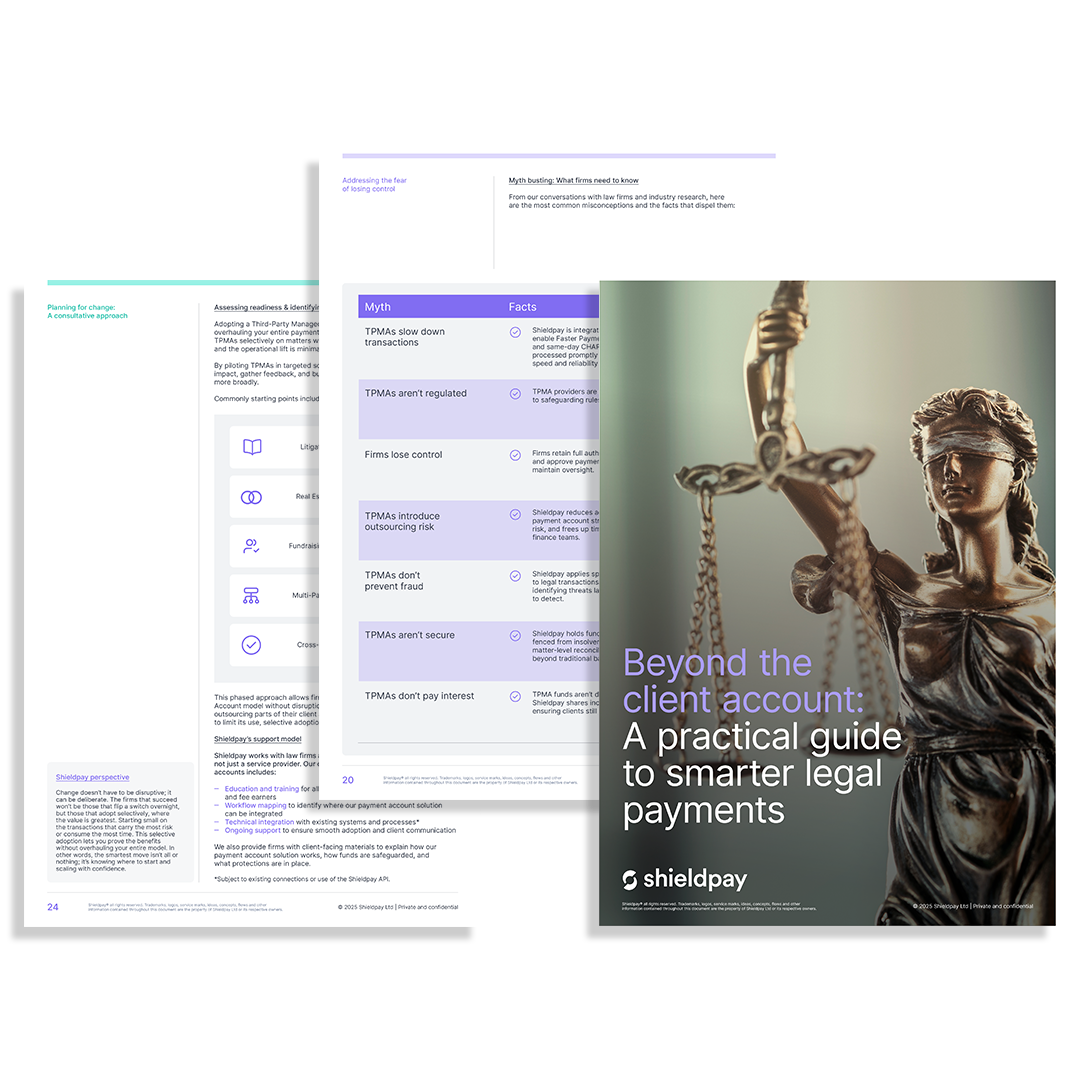

Inside the report

The legal sector is under increasing pressure to evolve how it handles client money. With rising regulatory pressure, increasing fraud risk, and growing operational overheads, many firms are asking: Is our current model still fit for purpose?

This white paper explores practical, compliant alternatives to traditional client accounts - designed to help firms reduce risk, improve efficiency, and maintain full control.

What's covered

The strengths and hidden costs of traditional client accounts

What regulated alternatives look like and how they work

How firms are reducing risk and admin burden without losing control

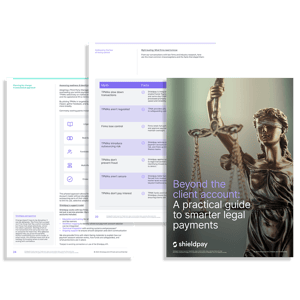

Common myths debunked (e.g. “outsourcing means less visibility”)

Questions to ask internally before making changes

How Shieldpay supports firms with education, onboarding, and client comms

Why it matters now

The SRA’s direction is clear and expectations are rising

Firms must reduce risk and show compliance

Clients expect transparency and security in how their money is handled

What you will gain

Access Shieldpay research and regulatory analysis you will not find elsewhere.

Steps to smarter client money management that your team can action.

Practical tools that lower admin and liability without losing control.

Move early and show clients you take security and transparency seriously.

What's covered

Whether you're a sole practitioner or part of a top-tier firm, this paper offers practical insights to help you make informed decisions. If you:

Manage or oversee client money in-house

Are concerned about fraud, reconciliation, or compliance risk

Want to improve transparency and client trust

Are exploring ways to future-proof their operations